In today’s ever-evolving financial landscape, savvy investors are constantly seeking opportunities to diversify their portfolios and maximize their returns. Among the myriad of options available, two prominent companies have captured the attention of market analysts and investors alike: Vodafone (VOD) and Nokia. These industry giants offer compelling investment prospects, each with its unique set of advantages and growth potential.

Vodafone (VOD): A Telecommunications Powerhouse

Vodafone, a multinational telecommunications company, has established itself as a dominant force in the global market. With operations spanning across Europe, Asia, Africa, and Oceania, the company boasts a vast customer base and a diverse array of services, including mobile voice and data, fixed-line broadband, and Internet of Things (IoT) solutions. One of the primary benefits of investing in VOD shares lies in the company’s unwavering commitment to innovation and technological advancement. Vodafone has consistently been at the forefront of the telecommunications revolution, embracing cutting-edge technologies such as 5G and exploring new frontiers in connectivity. This forward-thinking approach has positioned the company as a leader in its industry, enabling it to stay ahead of the competition and capitalize on emerging market trends.

Furthermore, Vodafone’s strong financial performance and robust balance sheet have instilled confidence in investors. The company’s consistent revenue growth, coupled with its strategic cost-cutting measures and efficient operations, have contributed to its overall profitability and shareholder value. As of today, the Vod shares price reflects the market’s confidence in the company’s long-term prospects.

Nokia: A Trusted Name in Telecommunications Infrastructure

Nokia, a Finnish multinational corporation, has long been revered for its exceptional contributions to the telecommunications industry. While its consumer-facing mobile phone division may have faded, the company’s telecommunications infrastructure business has remained a driving force, providing cutting-edge solutions to network operators worldwide.

One of the key advantages of investing in Nokia shares is the company’s unwavering commitment to research and development (R&D). Nokia has consistently invested substantial resources in advancing its technological capabilities, particularly in the areas of 5G, cloud computing, and network security. This dedication to innovation has positioned the company as a leader in the telecommunications infrastructure market, enabling it to secure lucrative contracts with major network operators globally.

Furthermore, Nokia’s diversified product portfolio and geographic reach have contributed to its resilience in the face of market fluctuations. The company’s strong presence in emerging markets, coupled with its well-established foothold in developed economies, has provided a stable revenue stream and mitigated the risks associated with regional economic downturns.

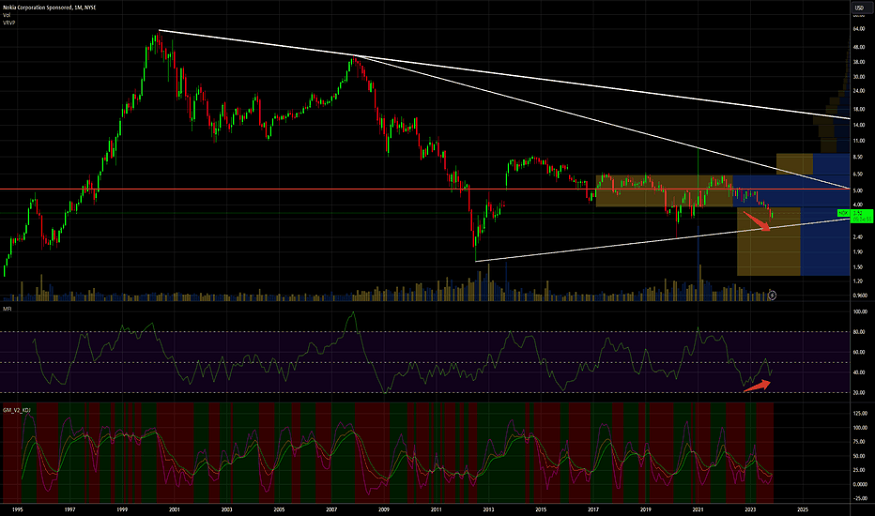

As of today, the Nokia share price reflects the market’s confidence in the company’s ability to capitalize on the growing demand for next-generation telecommunications infrastructure and its commitment to delivering cutting-edge solutions.

Conclusion

In the ever-changing landscape of the stock market, investing in established industry leaders with a proven track record of innovation and financial stability can be a wise decision. Both VOD and Nokia shares offer compelling investment prospects, each with its unique strengths and growth potential.

As investors navigate these opportunities, it’s essential to conduct thorough research, consult with financial advisors, and leverage reliable investment platforms like 5paisa. By making informed decisions and diversifying their portfolios, investors can potentially reap the benefits of these industry giants’ continued success and position themselves for long-term growth and profitability.